Miami PPP Fraud Lawyers

Aggressively Challenging Payment Protection Program Fraud Accusations in Florida

When the COVID-19 pandemic hit and states began enacting stay-at-home orders to prevent the spread of the disease, many businesses across the country were financially impacted. Some struggled to stay afloat, while many considered shuttering their doors as they were unable to keep up with expenses. To help stimulate the economy, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. One of the provisions of the CARES Act was the Paycheck Protection Program (PPP).

The PPP is a U.S. Small Business Administration-backed loan designed to help many businesses cover operating expenses they normally would have been able to had it not been for COVID-19. Many small and medium-sized businesses were approved for PPP funds. However, because these were unprecedented times and a stimulus such as this was relatively novel, the regulations concerning applying for and disbursing loans were not completely clear. Now, agents from various federal agencies are investigating possible PPP fraud cases.

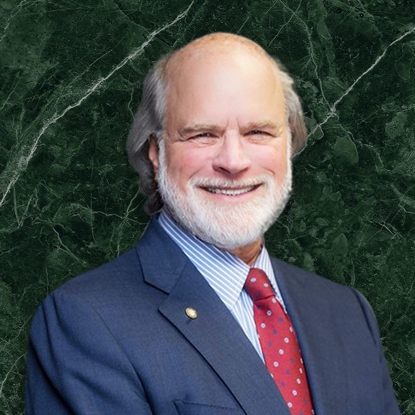

If you are under investigation or being prosecuted for alleged CARES Act fraud, contact Jeffrey S. Weiner, P.A. as soon as possible. The penalties you could face for a federal crime conviction are severe and can have lasting consequences on your personal and professional life. Our Miami PPP loan fraud attorneys are ready to deliver the counsel and aggressive defense you need to challenge the allegations made against you. We have over 50 years combined experience handling complex legal matters, and our founder, Attorney Jeffrey S. Weiner, has authored books and manuals on federal defense.

For help fighting your fraud charge, call us at (305) 985-6640 or submit an online contact form today.

PPP Loan Investigations

The Payment Protection Program loan provides financial assistance to non-profits, veterans organizations, Tribal businesses, sole proprietors, small business concerns, self-employed persons, and many others financially affected by the COVID-19 pandemic.

Funds from the loan are to be used for:

- Payroll

- Employee benefits

- Mortgage interest

- Rent

- Utilities

- COVID-19-related worker protection costs

- Uninsured property damage expenses resulting from looting

The loan attractive not only because of the aid it provides to struggling businesses but also because of the low interest rate and the potential for loan forgiveness if employee retention criteria are met. Federal investigators are finding that some individuals may have used deception or fraud to obtain a PPP loan.

Conduct investigators are looking into include, but is not limited to:

- Multiple loans: Owners could have applied and received a PPP loan from several lenders, which is prohibited.

- False statements: During the application process, owners are to provide information concerning their eligibility for a PPP loan. Unfortunately, some may have knowingly made material misrepresentations to qualify.

- Improper use of funds: PPP loans are to be used for specific business-related expenses. Owners who use funds for purposes other than those allowed by federal guidelines may be under investigation for SBA fraud.

When facing a federal investigation or prosecution, it is crucial to retain legal representation right away. Even at the early stages of your case, the actions you take or statements you make can have a serious impact on the outcome.

Our PPP fraud lawyers in Miami will be by your side every step of the way. We will provide clear advice and guidance and help you make informed decisions about how your matter proceeds.

Call for CARES Act Fraud Defense in Florida

You do not have to go through an SBA loan investigation or case alone. You have the right to have an attorney stand by you. At Jeffrey S. Weiner, P.A., our team is ready to deliver the zealous advocacy you need.

Discuss your case with our Miami PPP fraud attorneys by contacting us at (305) 985-6640.

Case Victories

Fully Prepared to Get the Best Possible Results in Each Case

-

Sentence Reduced Federal Crime

Client was indicted on a conspiracy to defraud.

-

Case Dismissed Professional License Defense

Client, a law student, was charged with criminal mischief and disorderly conduct.

-

Charges Reduced International Defense

A United States citizen was arrested and charged with assault and battery in Spain.

-

Case Dismissed Fraud Crime

Client was charged with title fraud and insurance fraud in different counties.

-

Sentence Reduced Federal Crime

Client was indicted with conspiracy to commit money laundering and making a materially false statement to a federal agent.

What Our Clients Are Saying About Us

-

"The best Criminal Justice Attorney in Miami"

Mr. Jeffrey S. Weiner, P.A. is the best Criminal Justice Attorney in Miami. A super lawyer with years of experience, he is a ...

- Moi H. -

"Excellent service"

Excellent service

- Mannix B. -

"I cannot recommend Jeffrey S. Weiner highly enough!"

I cannot recommend Jeffrey S. Weiner highly enough! From the very beginning, he made the entire legal process as seamless and ...

- Mac H. -

"Highly recommend"

I am incredibly grateful for the support I received from Diego Wiener and his team during a difficult time in my life. He ...

- Nicole L. -

"Exceptional legal support"

I cannot express enough how grateful I am for the exceptional legal support I received from the Law Offices of Jeffrey ...

- Linnea L. -

"Excellent representation!"

Excellent representation! Attorney Jeffrey Weiner and Yisel Villar were thorough and professional. They kept me well informed ...

- Amanda R. -

"Extremely prompt and professional"

Diego and Yisel were extremely prompt and professional, immediately making me feel heard and at ease that they were going to ...

- Daniel S. -

"Strongly recommend"

Diego W has been amazing! We interviewed 3 attorneys, and of the 3 we chose him. He is honest and knowledgeable, but ...

- Linette R.

Meet Our Attorneys - Your Criminal Defense Team

Serving Criminal Defense Clients for Over 50 Years

Why Hire Our Firm?

See What Makes Us Different

-

We Are Top-Rated Criminal Defense Attorneys

-

We Get the Best Possible Result in Each Case

-

We Have Served Criminal Defense Clients and Fellow Lawyers For Over 50 Years

-

We Wrote “the Book” on Federal Criminal Rules & Cases

-

We Are Available 24/7 for Emergencies & Offer Free Initial Consultations

.2111040928027.png)

[1].2307251422512.png)